𝐓𝐡𝐞𝐫𝐞 𝐢𝐬 𝐨𝐧𝐥𝐲 𝐨𝐧𝐞 𝐆𝐨𝐝 𝐢𝐧 𝐒𝐢𝐤𝐡𝐢𝐬𝐦

Allah vs Waheguru

God

Allah vs Waheguru

God

Opinion | Updated: 20/06/2025

Prof Raj Kumar Singh, DTU

India has the resources to ensure dignity for all universal healthcare, jobs, education, housing and clean cities. With the right policies, we can build a just, innovative and

Website: https://fullemployments.wordpress.com/

Our

nation has all the ingredients for prosperity: a large, dynamic population,

vast agricultural land, and abundant natural resources. Yet, we struggle to

fully realize aspirations like universal healthcare, full employment, and

innovative research and development that create well-paying jobs across

industries. Imagine a society where everyone can retire with security, where

food, housing, and healthcare are guaranteed—offering a life of dignity and

freedom. Picture a nation where all kinds of research are well-funded, and

innovative ideas for public welfare are continuously generated.

In

a resource-rich country like India, there’s no reason we can’t implement

policies that ensure sustainable infrastructure, modern education and job

training, quality healthcare, and housing for all. Imagine cities transformed

into clean, beautiful spaces that foster a sense of community. Envision an

economy where public and private sectors collaborate to achieve full employment

with fair wages, raising the standard of living for everyone. Picture societies

with ample access to health, education, and transportation, where economic

progress prioritizes human well-being over GDP, aligning our activities with

the rejuvenation of ecosystems.

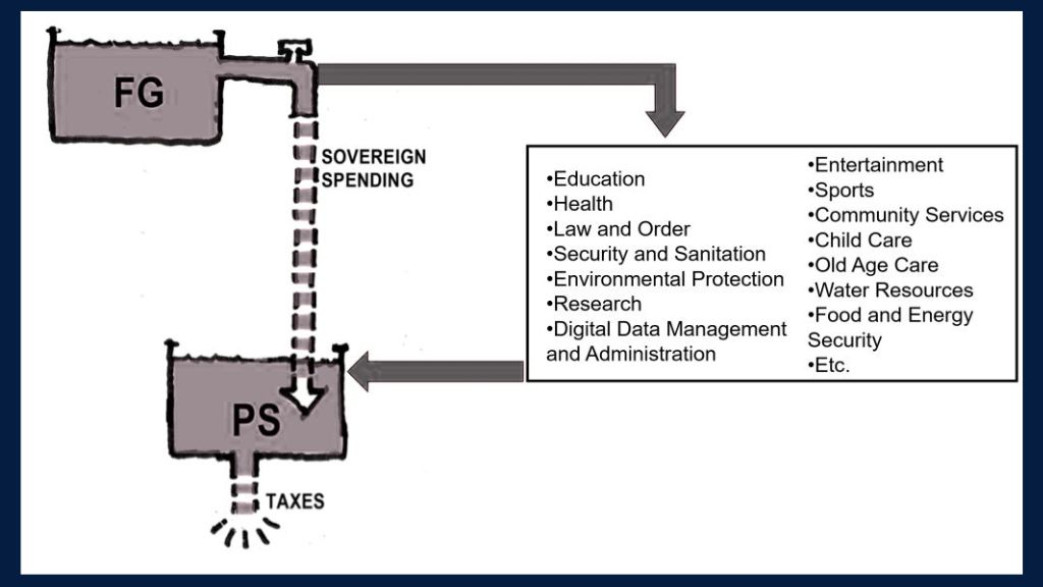

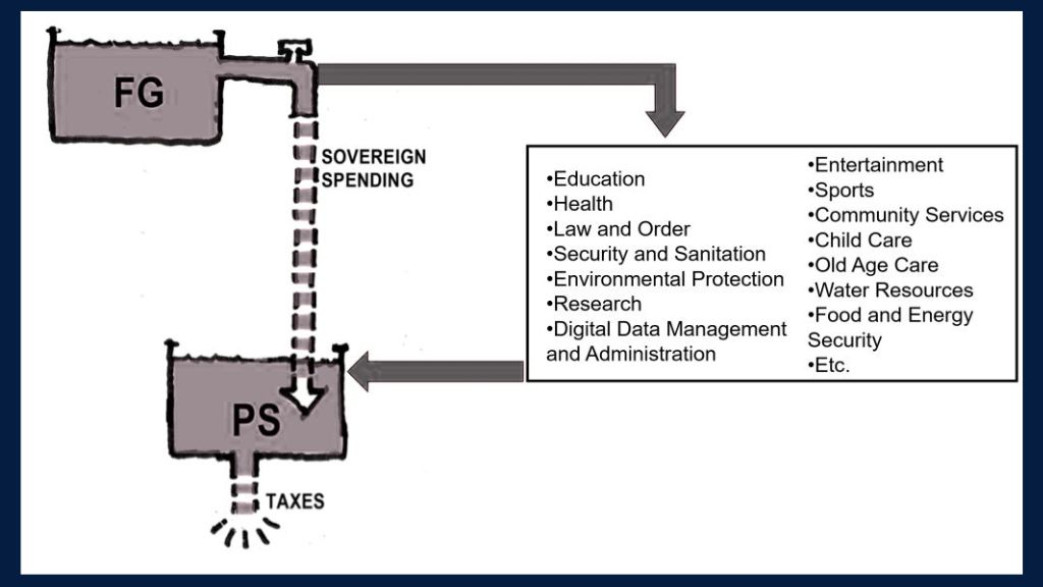

Traditionally,

it’s believed that taxpayers are the backbone of government finances, assuming

the government lacks its own money. This outdated perspective places

individuals like us as the primary financial supporters of government

operations. However, Modern Monetary Theory (MMT) challenges this notion,

asserting that the federal government, not the taxpayer, funds its activities.

Taxes serve other purposes, but the idea that taxes directly finance government

spending is a misconception.

If

policymakers continue to misunderstand fiscal policy—thinking the central

government is financially constrained and dependent on taxes—we will fail to

make the necessary investments to tackle rising unemployment, poverty,

environmental challenges, and prosperous India.

The

good news is that our understanding of nation-building, governance, and money

has evolved. By recognizing that the central government is constrained by

resources, not finances, we open new possibilities. This understanding allows

the government to mobilize idle resources for national development, leading to

a society where public welfare, employment, prosperity and sustainability

coexist harmoniously.

By

shifting our focus away from budget deficits and embracing a new perspective on

public finance, we create an economy that benefits everyone. Restrictive fiscal

policies rooted in unfounded concerns about government accounting have slowed

our growth, fragmented society, diminished living standards, and eroded our

environment. The lack of public investment reflects a failure of imagination—a

reluctance to envision a future with full employment, improved living

conditions, investment in future generations, and effective inflation control.

This lack of vision has also contributed to poverty, ecological harm, delaying

an economy that enhances life and protects the planet.

Understanding

money and governance provides powerful tools for any nation to redefine its

priorities: caring for people, honouring cultural identities, restoring

ecosystems, supporting sustainable agriculture, boosting production, and

encouraging innovation.

Modern

Monetary Theory (MMT), with its focus on real resources and correct

understanding of modern fiscal policies, offers alternative approaches to

achieving tangible improvements.

This understanding allows us to craft fiscal policies that empower local communities and strengthen the domestic economy through full employment. No community—be it a rural village or an urban neighbourhood—should be left behind. Equipped with clarity about what we can afford, we hold the power to create an inclusive economy. Let us envision, and then collectively build, a better future for our nation.

Traditional Government Finance vs. New Perspective

A sovereign nation like India can leverage strategic fiscal policies to

mobilize all underutilized resources—including its unemployed workforce—for

nation-building. By harnessing a deep understanding of fiscal mechanisms,

currency flow, and economic planning, India has the potential to become the first

major economy to achieve zero unemployment, eradicate poverty entirely, and

ensure a higher quality of life for all its citizens.